sbi tiny smart cards Product Features : Instant generation of Debit card. Used for PoS transaction (Contactless) through Android mobile phones. Usage for e-Com, International, E-mandate. Free of charge. Nil AMC. Green Banking: No use of plastic and card chip. Additional Information:

Here are seven security risks you should be aware of when using NFC technology. 1. Data Tampering. Data tampering occurs when a person manipulates the data exchanged .

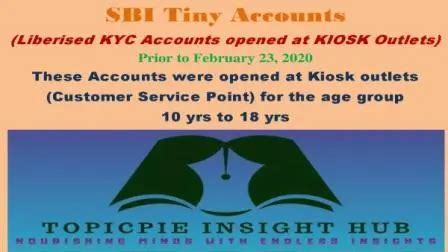

0 · SBI Tiny Accounts: A Comprehensive Guide

1 · Financial Inclusion & Financial Literacy: SBI Initiatives

If this is the case, you may want to check the following: • Make sure the device has the latest software update. • Check the device’s NFC settings are enabled. • Make sure the device is not .

In this comprehensive guide, we will explore everything you need to know about .SBI's answer to financial inclusion is the 'SBI Tiny project', which can in simple terms be .

In this comprehensive guide, we will explore everything you need to know about SBI’s Tiny Accounts, from their unique history to opening one with liberized KYC documents, and transitioning into a regular savings account. State Bank of India, in a bid to keep pace with the financial inclusion process in the country, is looking at launching 30 lakh more SBI tiny cards with biometric identification in a year's. State Bank of India (SBI) is planning to launch 3 million more SBI Tiny cards with biometric identification within a year. The move is significant as it will help the bank keep pace with the financial inclusion process in the country.Product Features : Instant generation of Debit card. Used for PoS transaction (Contactless) through Android mobile phones. Usage for e-Com, International, E-mandate. Free of charge. Nil AMC. Green Banking: No use of plastic and card chip. Additional Information:

For instance, the SBI has recently rolled out a one-use ‘Virtual Card’ for its net banking users, which allows them to make online payments without exposing their real debit and credit card .

You can use a Smart Payout Card at any Point of Sale (PoS) terminal at Merchant Establishments that accept VISA Cards. You can use a Smart Payout Card at any online merchant site that accepts VISA Cards, for e-commerce transactions. In a bid to capture the emerging rural banking opportunity, the country's largest commercial bank SBI is planning a nationwide roll-out of 'SBI Tiny Cards', which currently is in the pilot stage in three states.

Debit Card - Personal Banking. Cross Border Bill Payments through Bharat Bill Payment System Remittances to Foreign Universities through FLYWIRE. Setting up of Agri Clinic and Agri Business centres. PM Formalization of Micro Food Processing Enterprises (PMFME Scheme) Scheme Animal Husbandry Infrastructure Development Fund (AHIDF)Scheme PM .

To extend banking facilities to rural folk as part of its financial inclusion programme, the largest lender in the country, the State Bank of India (SBI), has started making direct payment to the.

YONO LITE SBI. YONO LITE SBI is State Bank’s mobile banking application for retail users. A safe, convenient and easy to use application with a host of features to help users manage their banking on the move. Available in Google Play Store, iOS App store and Windows marketplace. In this comprehensive guide, we will explore everything you need to know about SBI’s Tiny Accounts, from their unique history to opening one with liberized KYC documents, and transitioning into a regular savings account.

State Bank of India, in a bid to keep pace with the financial inclusion process in the country, is looking at launching 30 lakh more SBI tiny cards with biometric identification in a year's. State Bank of India (SBI) is planning to launch 3 million more SBI Tiny cards with biometric identification within a year. The move is significant as it will help the bank keep pace with the financial inclusion process in the country.

Product Features : Instant generation of Debit card. Used for PoS transaction (Contactless) through Android mobile phones. Usage for e-Com, International, E-mandate. Free of charge. Nil AMC. Green Banking: No use of plastic and card chip. Additional Information: For instance, the SBI has recently rolled out a one-use ‘Virtual Card’ for its net banking users, which allows them to make online payments without exposing their real debit and credit card .

You can use a Smart Payout Card at any Point of Sale (PoS) terminal at Merchant Establishments that accept VISA Cards. You can use a Smart Payout Card at any online merchant site that accepts VISA Cards, for e-commerce transactions. In a bid to capture the emerging rural banking opportunity, the country's largest commercial bank SBI is planning a nationwide roll-out of 'SBI Tiny Cards', which currently is in the pilot stage in three states.Debit Card - Personal Banking. Cross Border Bill Payments through Bharat Bill Payment System Remittances to Foreign Universities through FLYWIRE. Setting up of Agri Clinic and Agri Business centres. PM Formalization of Micro Food Processing Enterprises (PMFME Scheme) Scheme Animal Husbandry Infrastructure Development Fund (AHIDF)Scheme PM .

To extend banking facilities to rural folk as part of its financial inclusion programme, the largest lender in the country, the State Bank of India (SBI), has started making direct payment to the.

SBI Tiny Accounts: A Comprehensive Guide

Financial Inclusion & Financial Literacy: SBI Initiatives

Writing NFC tags is useful because NFC tags store short strings of information, like a URL, that can then be read and opened by the device—often a phone—scanning the tag. .

sbi tiny smart cards|Financial Inclusion & Financial Literacy: SBI Initiatives