difference between chip card and contactless card There are several options available for those interested in going contactless. Contactless Cards. The most popular and commonly used types of contactless payment are contactless debit and. Green Bay Packers 6-3 (third place, NFC North): The Packers, after a Week 10 bye, need to get back on track to strengthen their wild-card position by beating the Bears in .

0 · what is a contactless credit card

1 · touchless credit cards vs chip

2 · touchless cards vs chip cards

3 · contactless credit card insert chip

4 · contactless cards vs chip cards

5 · contactless card vs dip card

6 · contactless card meaning

7 · are contactless cards safer than chip

You can choose to Share or Receive Only. If you want to receive the other person’s contact details, but don’t want to share your own, tap Receive Only. The contact details, including email .

They enable the card to communicate with the card reader when the card is held near the reader during a transaction. Contactless cards also typically come with an EMV chip and the usual credit or debit card number, . Contactless credit cards have a small embedded chip emitting electromagnetic waves. This chip is not the “insert” chip you use instead of swiping. When you place your card within a few inches of.

They enable the card to communicate with the card reader when the card is held near the reader during a transaction. Contactless cards also typically come with an EMV chip and the usual credit or debit card number, expiration date, security code and magnetic stripe.

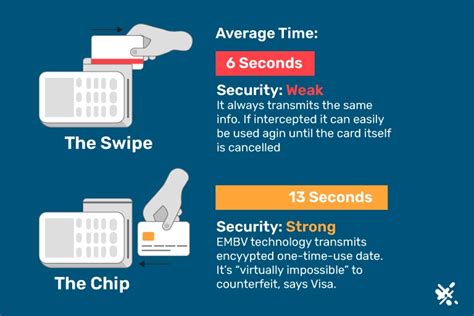

Which option is safer: contactless cards or EMV chip cards? Both payment options are safer than magstripe plastic, but they also both possess security limitations: Cards that use a signature requirement are easy to abuse if they ever fall into the wrong hands. There are several options available for those interested in going contactless. Contactless Cards. The most popular and commonly used types of contactless payment are contactless debit and.

Contactless payments are transactions made by tapping either a contactless card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal. Cards, phones, watches, and other devices use the same contactless technology. A contactless credit card allows you to make a secure transaction without swiping or inserting your chip. If you see the contactless symbol on the back of your payment card and on the payment reader, you can tap to pay. Contactless pay is widely accepted, but you can swipe or insert your contactless chip card when needed.

what is a contactless credit card

Q1 What is the difference between a contactless card and a contact chip card? Chip card technology was designed to reduce counterfeit, lost/stolen and card-not-received fraud. Chip cards can either be contact or contactless.

Using a method known as tap-to-pay, a contactless payment card eliminates the need to physically touch a payment terminal. This payment option requires that a retailer have a sales terminal.You know your payment card is contactless if it has the contactless indicator — four curved lines — printed somewhere on it. Most cards issued today by major banks are contactless by default, while cards with magnetic stripes for swiping are slowly being phased out entirely.

A contactless card is a credit or debit card which enables close-range transactions. Contactless cards also come with a chip and magnetic stripe, so you can insert your card or use the magnetic stripe if a terminal is not yet contactless- (or chip-) enabled.

Contactless credit cards have a small embedded chip emitting electromagnetic waves. This chip is not the “insert” chip you use instead of swiping. When you place your card within a few inches of.

touchless credit cards vs chip

They enable the card to communicate with the card reader when the card is held near the reader during a transaction. Contactless cards also typically come with an EMV chip and the usual credit or debit card number, expiration date, security code and magnetic stripe.

Which option is safer: contactless cards or EMV chip cards? Both payment options are safer than magstripe plastic, but they also both possess security limitations: Cards that use a signature requirement are easy to abuse if they ever fall into the wrong hands. There are several options available for those interested in going contactless. Contactless Cards. The most popular and commonly used types of contactless payment are contactless debit and.

Contactless payments are transactions made by tapping either a contactless card or payment-enabled mobile or wearable device over a contactless-enabled payment terminal. Cards, phones, watches, and other devices use the same contactless technology. A contactless credit card allows you to make a secure transaction without swiping or inserting your chip. If you see the contactless symbol on the back of your payment card and on the payment reader, you can tap to pay. Contactless pay is widely accepted, but you can swipe or insert your contactless chip card when needed.

Q1 What is the difference between a contactless card and a contact chip card? Chip card technology was designed to reduce counterfeit, lost/stolen and card-not-received fraud. Chip cards can either be contact or contactless. Using a method known as tap-to-pay, a contactless payment card eliminates the need to physically touch a payment terminal. This payment option requires that a retailer have a sales terminal.

You know your payment card is contactless if it has the contactless indicator — four curved lines — printed somewhere on it. Most cards issued today by major banks are contactless by default, while cards with magnetic stripes for swiping are slowly being phased out entirely.

touchless cards vs chip cards

nfc tags for note 4

nfc tags security

These include: Overlay skimmers: These fit seamlessly over the existing card slot. Insert skimmers: These are hidden inside the card reader’s slot. Insert shimmer: These fit into the slot where EMV chip cards are inserted. .

difference between chip card and contactless card|are contactless cards safer than chip