is transferring credit card balance smart Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if . Install Python and nfcpy. Download and install Python (2.7 or 3.5 or later). Note. Python may already be installed on your system if you are a Linux user. . Read and write .

0 · credit cards with balance transfer fee

1 · credit card balance transfer problems

2 · credit card balance transfer credit score

3 · balance transfer credit cards

4 · balance transfer credit card pros and cons

5 · balance transfer credit card interest

6 · are balance transfer credit cards worth it

7 · advantages of balance transfer credit cards

If they are both hanging out in your pocket, or if you have your card pressing against your phone, you might get an "NFC tag detected" notification. Swipe to get rid of this notification and move your phone away .

Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if you owe money on .

Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if .

credit cards with balance transfer fee

credit card balance transfer problems

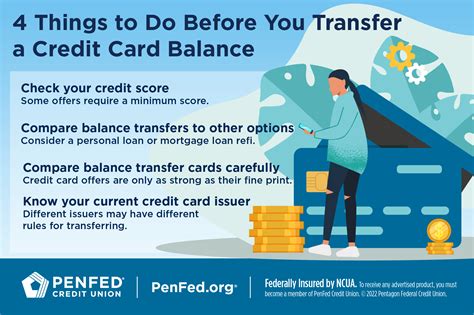

A balance transfer is the process of transferring debt from one credit card to another credit card, usually to one with a lower interest rate. This doesn’t get rid of your debt but it may help you save money on interest or possibly pay off the debt quicker. A balance transfer can save you money by moving your debt from a high-interest credit card to one with a lower APR. Learn how they work, and find a card that fits your needs. Balance transfer credit cards offer a 0% annual percentage rate (APR) on transferred balances for a certain period of time — sometimes as long as 21 months — giving you time to pay down your.Before applying for a credit card with an introductory 0% rate on balance transfers, consider the pros and cons in order to determine if a balance transfer is the right move for you..

Balance transfer credit cards offer advantages including consolidating multiple payments, lowering your total interest paid and paying off your debt faster. It's important to carefully. Balance transfer credit cards can help you get out of high-interest debt quickly and efficiently. There are several pitfalls to avoid that can end balance transfer periods early,. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money by having all your payments go toward knocking. A credit card balance transfer lets you transfer part or all of your balances from one credit card to another. Credit card companies may give you a balance transfer offer, such as a low or 0% intro APR on the balances that you transfer to the card for a limited time.

A balance transfer moves a balance from one account to another account or card, ideally to take advantage of a lower or 0% introductory APR, and provides more time to pay down debt. After an. Balance transfer credit cards help you save money by allowing you to move debt from a high-interest credit card to one that charges as little as 0% APR for 12 months or longer. They can also help you consolidate your debt into a single payment if . A balance transfer is the process of transferring debt from one credit card to another credit card, usually to one with a lower interest rate. This doesn’t get rid of your debt but it may help you save money on interest or possibly pay off the debt quicker.

A balance transfer can save you money by moving your debt from a high-interest credit card to one with a lower APR. Learn how they work, and find a card that fits your needs. Balance transfer credit cards offer a 0% annual percentage rate (APR) on transferred balances for a certain period of time — sometimes as long as 21 months — giving you time to pay down your.Before applying for a credit card with an introductory 0% rate on balance transfers, consider the pros and cons in order to determine if a balance transfer is the right move for you..

Balance transfer credit cards offer advantages including consolidating multiple payments, lowering your total interest paid and paying off your debt faster. It's important to carefully. Balance transfer credit cards can help you get out of high-interest debt quickly and efficiently. There are several pitfalls to avoid that can end balance transfer periods early,. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money by having all your payments go toward knocking. A credit card balance transfer lets you transfer part or all of your balances from one credit card to another. Credit card companies may give you a balance transfer offer, such as a low or 0% intro APR on the balances that you transfer to the card for a limited time.

credit card balance transfer credit score

balance transfer credit cards

balance transfer credit card pros and cons

balance transfer credit card interest

are balance transfer credit cards worth it

On 27 January 2012, Nintendo President Satoru Iwata announced in a briefing that the controller of the Wii U home console will have an installable NFC function. By installing this . See more

is transferring credit card balance smart|balance transfer credit card pros and cons