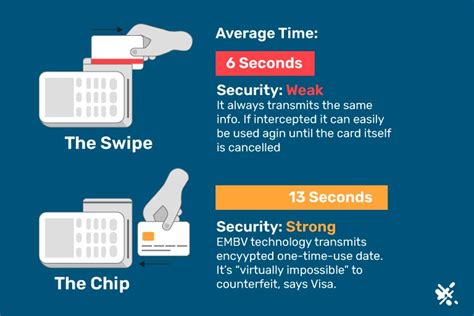

emv chip vs rfid chip EMV chip cards are embedded with a special microprocessor chip that stores and protects cardholder data. Every time you make a purchase, this chip creates a unique transaction code that cannot be used again. This makes EMV chip cards much more secure than traditional magnetic stripe cards. AP Defensive Player of the Year Ed Reed. Passing Leader Daunte Culpepper, 4717 Yds. .

0 · tap vs dip emv card

1 · rfid vs emv

2 · rfid card symbol

3 · nfc vs rfid

4 · how do emv cards work

5 · contactless card vs emv card

6 · can you dip emv cards

7 · are emv cards safe

The National Football League playoffs for the 2002 season began on January 4, 2003. The postseason tournament concluded with the Tampa Bay Buccaneers defeating the Oakland Raiders in Super Bowl XXXVII, . See more

With an EMV card, the small EMV chip ensures a stolen card isn't being used. EMV cards can be contactless and use the same kind of technology that enables NFC to be processed without any physical touching.

With an EMV card, the small EMV chip ensures a stolen card isn't being used. EMV cards can be contactless and use the same kind of technology that enables NFC to be processed without any physical touching.

EMV chip cards are embedded with a special microprocessor chip that stores and protects cardholder data. Every time you make a purchase, this chip creates a unique transaction code that cannot be used again. This makes EMV chip cards much more secure than traditional magnetic stripe cards.

RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the form.Which option is safer: contactless cards or EMV chip cards? Both payment options are safer than magstripe plastic, but they also both possess security limitations: Cards that use a signature requirement are easy to abuse if they ever fall into the wrong hands. Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology. EMV chips embedded in credit cards help fight fraud by making it impossible to take card data from one in-person transaction and reuse it.

EMV Credit Cards vs. NFC Credit Cards. EMV credit cards contain a tiny computer chip with more sophisticated security features than magstripe cards (they’re encrypted). EMV credit cards are processed differently than magstripe cards—they’re dipped instead of swiped. NFC cards are equipped with RFID technology that allows customers to . EMV vs. RFID – What is the Difference? While RFID technology can be used for contactless payment processing, it is not the same as EMV (Europay, Mastercard, and Visa) technology. EMV technology refers specifically to chip-based credit and debit cards that process payments using dynamic authentication.

Meanwhile, the EMV technology ensures that information is tokenized and remains secure during transmission. In other words, EMV keeps your information safe and NFC allows for contactless payment. Both come into play when you use a chip-and-pin card, regardless of whether you choose to dip or tap. Both are part of the most secure payment card security protocol to which the United States are in the midst of migrating from the magnetic stripe technology. But, while an EMV card needs actual contact when making a payment, an RFID card transmits information through radio waves using a hidden chip. So it's enough to hold it inches from a .With an EMV card, the small EMV chip ensures a stolen card isn't being used. EMV cards can be contactless and use the same kind of technology that enables NFC to be processed without any physical touching.

EMV chip cards are embedded with a special microprocessor chip that stores and protects cardholder data. Every time you make a purchase, this chip creates a unique transaction code that cannot be used again. This makes EMV chip cards much more secure than traditional magnetic stripe cards. RFID payments work by transmitting information between a credit card — specifically, the computer chip and antenna embedded within it — and a contactless reader. That information takes the form.Which option is safer: contactless cards or EMV chip cards? Both payment options are safer than magstripe plastic, but they also both possess security limitations: Cards that use a signature requirement are easy to abuse if they ever fall into the wrong hands. Inside of a credit card, there is an EMV chip with 8 contact pins that facilitates EMV transactions, which are safer than “swiped” payments. If your credit card is contactless-enabled, there is also a tiny RFID chip and a long, winding antenna inside the card, which allow for contactless payments via RFID technology.

register smart card stagecoach

EMV chips embedded in credit cards help fight fraud by making it impossible to take card data from one in-person transaction and reuse it. EMV Credit Cards vs. NFC Credit Cards. EMV credit cards contain a tiny computer chip with more sophisticated security features than magstripe cards (they’re encrypted). EMV credit cards are processed differently than magstripe cards—they’re dipped instead of swiped. NFC cards are equipped with RFID technology that allows customers to .

EMV vs. RFID – What is the Difference? While RFID technology can be used for contactless payment processing, it is not the same as EMV (Europay, Mastercard, and Visa) technology. EMV technology refers specifically to chip-based credit and debit cards that process payments using dynamic authentication.

Meanwhile, the EMV technology ensures that information is tokenized and remains secure during transmission. In other words, EMV keeps your information safe and NFC allows for contactless payment. Both come into play when you use a chip-and-pin card, regardless of whether you choose to dip or tap.

rto smart card application form

tap vs dip emv card

rfid vs emv

remote smart card reader android

1. Google Pay – Google’s Solution To Mobile Payment. Google is known to lead innovation in various fields of technology whether it is quantum technology or mobile OS. This is their masterstroke in the market for Top NFC .I found some on NFC bank, but can't test them since my tablet isn't NFC compatible. I think one set got linked from here but another one is a bit younger Edit: I'm an .

emv chip vs rfid chip|can you dip emv cards