contactless card us forecast In recent years, the FRPS has collected data for a sample of the largest depository institutions by deposit size through annual surveys.1 The annual . See more Evolis Badgy 200 (bought new): + Cheap. + Compact. + Comes bundled with bare bones printing software. - The least "edge-to-edge" of all of the printers I've gotten with a fairly thick unprintable border around full card prints. - Very weak and usually patchy color prints.

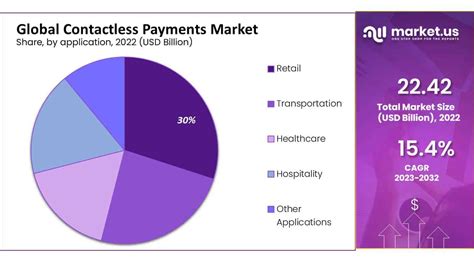

0 · contactless payment market share

1 · contactless payment market growth

IOS gives two (three) solutions to NFC passes: HCE - limited solely to Apple VAS protocol. Requires getting a manual approval from Apple via e-mail. If there’s no big partner supporting .

As in the past, the surveys collected annual data, and the effects of the pandemic can be seen by comparing 2020 estimates with those for previous years, such as in the shares of cards, ACH, and checks at large depository institutions from the DFIPS or in volumes for cards from the NPIPS. To study how the use of . See moreIn recent years, the FRPS has collected data for a sample of the largest depository institutions by deposit size through annual surveys.1 The annual . See moreAdoption of new payment technologies can be viewed not only in terms of more frequent payments by current users (i.e., intensity of use) but also in terms of payers using them for the first time (i.e., first-time use). The analysis below looks at the intensity of use of . See moreIn the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from Consumer adoption of contactless payments in the U.S. has been fueled by a combination of factors, including the growing availability of contactless-enabled cards and mobile phones, and the increasing number of merchants accepting contactless payments..02 trillion in 2018 to The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030..05 trillion in 2019, before increasing to The graph shows the contactless payment market revenue in the United States from 2014 to 2025. In 2016, the contactless payment market in the United States generated some 29 billion..11 trillion in 2020.

2024-2029. Forecast period. 'Contactless Payment Transactions to Hit .7 Trillion Globally by 2029, as Soft Point-of-Sale & Ticketing Roll-outs Accelerate Growth' Tuesday, 25 June 2024. View press release. Overview. As of August 1, 2023, users could load debit or credit cards, transit cards, rewards cards, boarding passes, events tickets, digital keys, ID cards, and Apple Cash accounts into Apple Wallet. We’re nearing a tipping point in the U.S. Most merchants can now accept contactless payments. More card issuers are delivering contactless cards to consumers. There’s a big mobile payments push from popular companies such as Apple and Google. According to a forecast by Juniper Research, total contactless payment transactions are expected to grow to more than trillion by 2027, with a whopping 221% increase in contactless payments projected between 2022 and 2026.

The global contactless payment market size is anticipated to witness 15% CAGR through 2026 impelled by growing demand from consumers and merchants to reduce transaction & billing time. The US card payments market is forecast to grow by 5% in 2024 to reach .6 trillion, supported by high consumer preference for electronic payments, according to GlobalData, a leading data and analytics company.In the face of declines in in-person card payments overall in 2020, contactless card payments grew more rapidly, increasing at a rate of 172.30 percent since 2019 to reach 3.7 billion in 2020. By value, contactless card payments increased from Consumer adoption of contactless payments in the U.S. has been fueled by a combination of factors, including the growing availability of contactless-enabled cards and mobile phones, and the increasing number of merchants accepting contactless payments..02 trillion in 2018 to The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030..05 trillion in 2019, before increasing to The graph shows the contactless payment market revenue in the United States from 2014 to 2025. In 2016, the contactless payment market in the United States generated some 29 billion..11 trillion in 2020. 2024-2029. Forecast period. 'Contactless Payment Transactions to Hit .7 Trillion Globally by 2029, as Soft Point-of-Sale & Ticketing Roll-outs Accelerate Growth' Tuesday, 25 June 2024. View press release. Overview.

contactless payment market share

As of August 1, 2023, users could load debit or credit cards, transit cards, rewards cards, boarding passes, events tickets, digital keys, ID cards, and Apple Cash accounts into Apple Wallet.

We’re nearing a tipping point in the U.S. Most merchants can now accept contactless payments. More card issuers are delivering contactless cards to consumers. There’s a big mobile payments push from popular companies such as Apple and Google. According to a forecast by Juniper Research, total contactless payment transactions are expected to grow to more than trillion by 2027, with a whopping 221% increase in contactless payments projected between 2022 and 2026.

The global contactless payment market size is anticipated to witness 15% CAGR through 2026 impelled by growing demand from consumers and merchants to reduce transaction & billing time.

contactless payment market growth

sblocco smart card aruba

It is possible physically for the phone hardware but there are software problems, payment works but it's provided by google. I read about using phone as nfc tag recently and .

contactless card us forecast|contactless payment market growth