cba credit card contactless Some CommBank cards are ineligible including Keycard, Travel Money Card, Mastercard Business Debit Card, Corporate Card. Discover how you can pay safely and securely from your smartphone with accessible Contactless Payments, without having to worry about having a physical card on you when you're out shopping. NFC reader design I - How to build your own reader. NFC expands to many .

0 · how to make contactless purchases

1 · how to make contactless payments

2 · contactless payments without pin

3 · contactless payments tap and go

4 · contactless debit card

5 · contactless credit card payments

$9.40

Some CommBank cards are ineligible including Keycard, Travel Money Card, Mastercard Business Debit Card, Corporate Card. Discover how you can pay safely and securely from your smartphone with accessible Contactless Payments, without having to worry about having a .Some CommBank cards are ineligible including Keycard, Travel Money Card, Mastercard Business Debit Card, Corporate Card. Discover how you can pay safely and securely from your smartphone with accessible Contactless Payments, without having to worry about having a physical card on you when you're out shopping.Tap & Pay allows you to use your compatible Android mobile phone with the CommBank app to make contactless purchases. Tap & Pay is available for compatible NFC enabled phones running Android 4.4 or above.Google Pay is a free third party app that allows CommBank customers with an eligible debit or credit card to make tap and pay transactions. To make a payment using an Android phone, simply wake and hold your phone near the terminal.

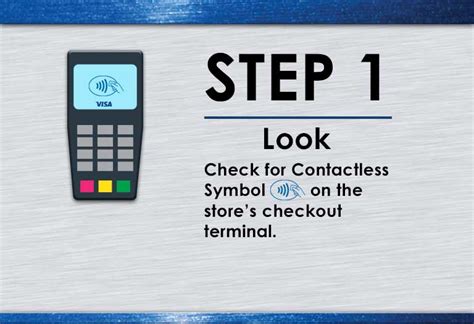

Australia's four major banks – CBA, Westpac, NAB and ANZ are offering their customers contactless payments. All new bank cards come automatically equipped with contactless payment technology. To make a tap and go payment, all you need to do is wave your bank card (or phone or wearable device) above a payment terminal and the payment will be . With contactless or “tap to pay” cards, a small radio frequency antenna and microchip inside the card allow a transaction to be processed without having to enter a personal identification number (PIN) or sign a receipt.

A contactless payment is a transaction you can make without swiping or inserting a card. It is a safe and easy way to make in-person purchases with a card or mobile device. ‘Contactless. Contactless payments operate either through cards or through mobile apps and digital wallets. These payments typically use either radio-frequency identification (RFID) or near field."As of August, we estimate around 90% CBA credit and debit card payments made in-person were made contactless, rather than inserting, and approximately half of those contactless payments.

Eight in ten (80%) in-person contactless payments made from digital wallets using Commonwealth Bank of Australia (CBA) debit and credit cards are made by tapping an Apple device, the bank has told a government inquiry into mobile payments and digital financial services.Canadians are clearly turning to tech-driven and contactless transaction methods amid the ongoing pandemic. The average Canadian uses Tap & Pay 10 times a month and buys something with their credit card and debit card eight times and seven times a month, respectively.

Some CommBank cards are ineligible including Keycard, Travel Money Card, Mastercard Business Debit Card, Corporate Card. Discover how you can pay safely and securely from your smartphone with accessible Contactless Payments, without having to worry about having a physical card on you when you're out shopping.Tap & Pay allows you to use your compatible Android mobile phone with the CommBank app to make contactless purchases. Tap & Pay is available for compatible NFC enabled phones running Android 4.4 or above.Google Pay is a free third party app that allows CommBank customers with an eligible debit or credit card to make tap and pay transactions. To make a payment using an Android phone, simply wake and hold your phone near the terminal.

Australia's four major banks – CBA, Westpac, NAB and ANZ are offering their customers contactless payments. All new bank cards come automatically equipped with contactless payment technology. To make a tap and go payment, all you need to do is wave your bank card (or phone or wearable device) above a payment terminal and the payment will be . With contactless or “tap to pay” cards, a small radio frequency antenna and microchip inside the card allow a transaction to be processed without having to enter a personal identification number (PIN) or sign a receipt.A contactless payment is a transaction you can make without swiping or inserting a card. It is a safe and easy way to make in-person purchases with a card or mobile device. ‘Contactless.

Contactless payments operate either through cards or through mobile apps and digital wallets. These payments typically use either radio-frequency identification (RFID) or near field."As of August, we estimate around 90% CBA credit and debit card payments made in-person were made contactless, rather than inserting, and approximately half of those contactless payments. Eight in ten (80%) in-person contactless payments made from digital wallets using Commonwealth Bank of Australia (CBA) debit and credit cards are made by tapping an Apple device, the bank has told a government inquiry into mobile payments and digital financial services.

how to make contactless purchases

activare smart card digi

acs smart card and reader tool download

Tap and Chip are very safe, while swipping very unsafe. However, when using the Chip with some machines, specially ATMs and some gas pumps, you have to enter the card all the way in .

cba credit card contactless|contactless credit card payments