santander contactless card uk The contactless card payment limit rose from £45 to £100 on 15 October. But . Method 2: Looking for signs on the card: Some cards may have visible indications indicating the presence of RFID or NFC technology. Look for any logos or symbols on the card that suggest contactless communication. .

0 · tsb apply for contactless card

1 · santander pay by phone

2 · santander contactless card apply

3 · santander change pin

4 · santander change payment limit

5 · how to activate contactless card

6 · debit card tap limit

7 · contactless payment limit

A contactless card, also known as a “tap-to-pay” card, is a type of payment card equipped with near-field communication (NFC) technology. Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card .

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless .You can now link most Santander debit cards and credit cards to your smartphone or device to .

Make quick and secure payments of up to £30 with contactless payments through Santander . The contactless card payment limit rose from £45 to £100 on 15 October. But .Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.You can now link most Santander debit cards and credit cards to your smartphone or device to make secure cashless payments. Mobile payments can be made at any contactless retailer, although some retailers may have specific limits. The Basic contactless debit card does not allow mobile payments.

Make quick and secure payments of up to £30 with contactless payments through Santander UK's business credit and debit cards. Find out more at Santander.co.uk.

Contactless debit card payments (except for the under 16s Basic Current Account) The option to use your card with digital wallets such as Apple Pay, Google Pay and Samsung Pay. No fees when using Santander cash machines abroad¹. Access to online banking and the Santander mobile banking app.

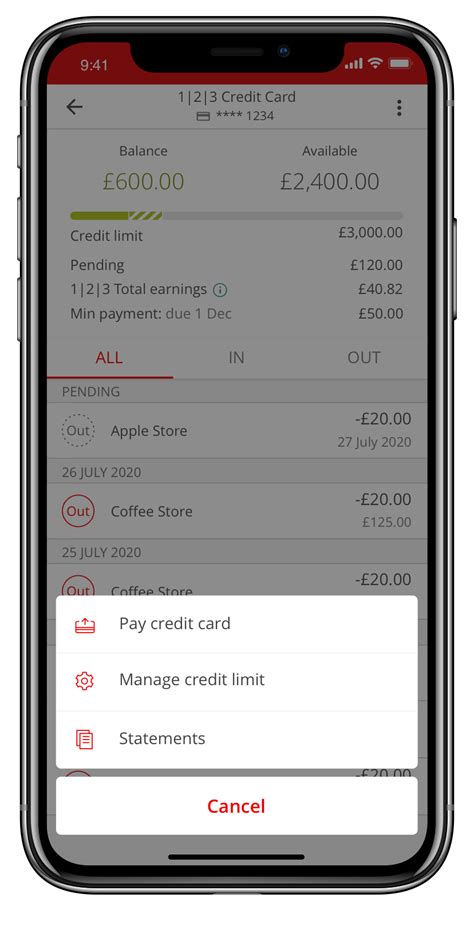

The contactless card payment limit rose from £45 to £100 on 15 October. But Bank of Scotland, Danske Bank UK, Halifax, Lloyds and Starling will let you set your own limit, with Santander becoming the latest to also do so. Find out how contactless payment cards work, the limit on contactless payments, if contactless cards are safe to use, all about contactless protectors and whether you can cancel or opt out of contactless cards. The bank is offering customers the option of changing their card limit to any multiple of GBP 5 up to GBP 95 via the chat service on its mobile banking app and online banking website. Customers can also opt to turn off their card’s .

I did more research on the main Santander website where it says that they only offer self chosen limits on MasterCards and that the only way to have a card with a limit below £100 is to have a debit card replaced by a MasterCard! Santander, Virgin Money, HSBC, Nationwide and First Direct said customers could request a non-contactless card. Lloyds Banking Group said customers request this and also turn off contactless using their app.

The card allows you to make purchases up to £45 in seconds wherever you see the contactless indicator. The card also allows you to make online and mobile payments using Apple Pay, Google Pay, Samsung Pay, or Santander Wallet.

Pay for purchases of £45 or less with your contactless card, wherever you see the Contactless Indicator.You can now link most Santander debit cards and credit cards to your smartphone or device to make secure cashless payments. Mobile payments can be made at any contactless retailer, although some retailers may have specific limits. The Basic contactless debit card does not allow mobile payments.

Make quick and secure payments of up to £30 with contactless payments through Santander UK's business credit and debit cards. Find out more at Santander.co.uk. Contactless debit card payments (except for the under 16s Basic Current Account) The option to use your card with digital wallets such as Apple Pay, Google Pay and Samsung Pay. No fees when using Santander cash machines abroad¹. Access to online banking and the Santander mobile banking app.

The contactless card payment limit rose from £45 to £100 on 15 October. But Bank of Scotland, Danske Bank UK, Halifax, Lloyds and Starling will let you set your own limit, with Santander becoming the latest to also do so. Find out how contactless payment cards work, the limit on contactless payments, if contactless cards are safe to use, all about contactless protectors and whether you can cancel or opt out of contactless cards.

tsb apply for contactless card

The bank is offering customers the option of changing their card limit to any multiple of GBP 5 up to GBP 95 via the chat service on its mobile banking app and online banking website. Customers can also opt to turn off their card’s . I did more research on the main Santander website where it says that they only offer self chosen limits on MasterCards and that the only way to have a card with a limit below £100 is to have a debit card replaced by a MasterCard! Santander, Virgin Money, HSBC, Nationwide and First Direct said customers could request a non-contactless card. Lloyds Banking Group said customers request this and also turn off contactless using their app.

hardware security module smart card

halifax transit smart card

$32.95

santander contactless card uk|santander change pin