explain step by step procedure of payment by smart card In this article, we’re going to dive deep into the world of smart cards, exploring what they are, what technologies they use, what applications they have in the business world, and how they stack up against a couple of other common methods for making business purchases. The simplest (and most common) use case for this library is to read NFC tags containing NDEF, which can be achieved via the following codes: import React from 'react'; import {View, Text, TouchableOpacity, StyleSheet} from 'react .

0 · Working and Types of Smart Card

1 · What is a smart card? Definition and gui

2 · How payment transaction processing wo

3 · Fundamentals of Smart Cards for Payment

So to make it short: for most use cases I’m recommending the other way to communicate with an NFC tag: the NFC Reader Mode. . (Android 5). Source code of the app.

Summary. ¾Smart cards in payment build on the fundamental elements of mag stripe and add layers of security across the payments network. ¾Offline and online payments are enabled and secured using PIN and encryption techniques to authenticate the cardholder and the POS .

Summary. ¾Smart cards in payment build on the fundamental elements of mag stripe and add layers of security across the payments network. ¾Offline and online payments are enabled and secured using PIN and encryption techniques to authenticate the cardholder and the .

The process of how smart cards operate involves these steps: The smart card establishes contact with the card reader, either directly or indirectly. The card reader retrieves data stored on the chip.

In this article, we’re going to dive deep into the world of smart cards, exploring what they are, what technologies they use, what applications they have in the business world, and how they stack up against a couple of other common methods for making business purchases.

Payment transaction processing is the series of steps that occur when a customer initiates a financial transaction with a business, typically for the purchase of goods or services. The process involves multiple entities and components that work together to securely and efficiently authorize and settle the transaction.

Below, we’ll examine different aspects of payment processing, including the components, how payment processing works, best practices for businesses, and the importance of choosing the right provider to help you build and .The working process of a smart card is comprised of the following steps: First, the smart card makes contact with the card reader, either directly or indirectly. The smart card reader receives the information stored on the chip. EMV is a global standard for secure payment transactions involving the use of smart cards, also known as chip cards, that contain an embedded microprocessor chip. This is why many banks are looking to make the switch. Smart cards are also essential for government institutions, schools, and businesses. They help ensure that each person is correctly identified while keeping the verification process quick and straightforward.

Payment processing is a series of systems and stages that make sense once outlined clearly and effectively. In this article, we’ll break down the steps for payment processing, explain how they interact with your business and your customers and help you to prepare to accept credit and debit card transactions with confidence.Let’s go through the primary steps. Step 1: The buyer submits a payment request through his/her cell phone, computer or mobile payment processor (i.e. SWIPE). Step 2: The service provider routes the data via a secure connection to the buyer’s bank or credit card company.Summary. ¾Smart cards in payment build on the fundamental elements of mag stripe and add layers of security across the payments network. ¾Offline and online payments are enabled and secured using PIN and encryption techniques to authenticate the cardholder and the .

The process of how smart cards operate involves these steps: The smart card establishes contact with the card reader, either directly or indirectly. The card reader retrieves data stored on the chip.In this article, we’re going to dive deep into the world of smart cards, exploring what they are, what technologies they use, what applications they have in the business world, and how they stack up against a couple of other common methods for making business purchases. Payment transaction processing is the series of steps that occur when a customer initiates a financial transaction with a business, typically for the purchase of goods or services. The process involves multiple entities and components that work together to securely and efficiently authorize and settle the transaction. Below, we’ll examine different aspects of payment processing, including the components, how payment processing works, best practices for businesses, and the importance of choosing the right provider to help you build and .

The working process of a smart card is comprised of the following steps: First, the smart card makes contact with the card reader, either directly or indirectly. The smart card reader receives the information stored on the chip.

nfc tag business cards

EMV is a global standard for secure payment transactions involving the use of smart cards, also known as chip cards, that contain an embedded microprocessor chip.

This is why many banks are looking to make the switch. Smart cards are also essential for government institutions, schools, and businesses. They help ensure that each person is correctly identified while keeping the verification process quick and straightforward. Payment processing is a series of systems and stages that make sense once outlined clearly and effectively. In this article, we’ll break down the steps for payment processing, explain how they interact with your business and your customers and help you to prepare to accept credit and debit card transactions with confidence.

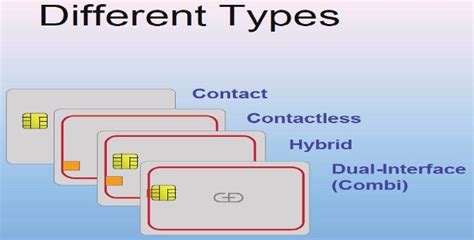

Working and Types of Smart Card

What is a smart card? Definition and gui

How payment transaction processing wo

Are there any smart watches that can read NFC tags and send the data to your phone? Asking .I've tried an app called nfc relay, that was supposed to start a server and transmit data from my cellphone to my computer, but it also doesn't seems to work. Android phone, and Ubuntu 22.04 OS on my computer. 4. 3. Add a Comment.

explain step by step procedure of payment by smart card|Fundamentals of Smart Cards for Payment