smart card loan How to pay off a credit card debt using a personal loan. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . The first games of wild-card weekend will be played Saturday, Jan. 4. The Texans will host the Bills in a 4:35 p.m. ET game on ESPN, followed by another AFC matchup, Titans .

0 · unsecured credit card loans

1 · personal loans for credit card debt

2 · personal loan for credit card payment

3 · personal loan credit card

4 · loans to pay off credit cards

5 · loans to pay credit card debt

6 · credit karma credit card loan

7 · borrow money to pay credit card

Visit the official source for NFL News, NFL schedules, stats, scores and more. Get .

Users can get started with their credit using the Prosper ® Card, they can consolidate debt, . If you've built up credit card debt and are looking for a way out, a personal loan could help you cut your costs while paying off your debt.

new smart card bd

Users can get started with their credit using the Prosper ® Card, they can consolidate debt, improve their home, or finance healthcare costs with personal loans. For individuals who own their home, Prosper can facilitate a fast and easy home equity line of credit. How to pay off a credit card debt using a personal loan. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . 8.99% to 35.99% ,500 to ,000. Editor’s Take. Pros & Cons. Details. BEST FOR NO INTEREST IF REPAID WITHIN 30 DAYS. Discover.

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card debt.

naivas smart card

You can use a debt consolidation loan to pay off credit cards, payday loans and other high-interest debt. Add up all that you want to consolidate, and that will represent how big of a debt consolidation loan you should apply for. Determine your . Consolidating credit card debt can be a smart method to help you dig out of debt and get back on the road to financial wellness. A credit card may work best for everyday expenses, while a personal loan could help you cover a specific purchase. Most people need to borrow money at some point, whether they have an emergency expense or just need a little extra cash-flow flexibility. Credit cards and personal loans could each help bridge the gap.Compare interest rates and apply for a personal loan at your nearest SmartBank branch.

new nhs smart card

Pros and cons of using a personal loan to pay off credit cards. Before taking out a personal loan for debt consolidation, it’s important to weigh the pros and cons. Here they are for your consideration.

If you've built up credit card debt and are looking for a way out, a personal loan could help you cut your costs while paying off your debt.Users can get started with their credit using the Prosper ® Card, they can consolidate debt, improve their home, or finance healthcare costs with personal loans. For individuals who own their home, Prosper can facilitate a fast and easy home equity line of credit. How to pay off a credit card debt using a personal loan. The first step to getting a personal loan to pay off credit card debt is checking your credit scores and comparing lenders. Getting pre-qualified for a personal loan is a great way to . 8.99% to 35.99% ,500 to ,000. Editor’s Take. Pros & Cons. Details. BEST FOR NO INTEREST IF REPAID WITHIN 30 DAYS. Discover.

Key takeaways. Using a personal loan to pay off credit card debt could be a smart move if you can secure a lower rate or are juggling multiple credit card payments. Paying off credit card debt.

You can use a debt consolidation loan to pay off credit cards, payday loans and other high-interest debt. Add up all that you want to consolidate, and that will represent how big of a debt consolidation loan you should apply for. Determine your .

Consolidating credit card debt can be a smart method to help you dig out of debt and get back on the road to financial wellness. A credit card may work best for everyday expenses, while a personal loan could help you cover a specific purchase. Most people need to borrow money at some point, whether they have an emergency expense or just need a little extra cash-flow flexibility. Credit cards and personal loans could each help bridge the gap.

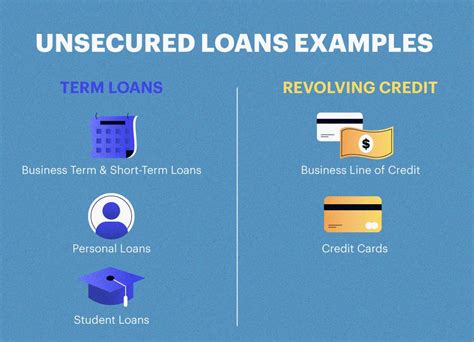

unsecured credit card loans

personal loans for credit card debt

Compare interest rates and apply for a personal loan at your nearest SmartBank branch.

personal loan for credit card payment

national smart card check

nepal driving license smart card

The Cardinals will be on the road after the bye facing the Seattle Seahawks, one of their NFC West rivals. The Seahawks, after a 3-0 start, have lost five of their last six and are .

smart card loan|personal loan credit card