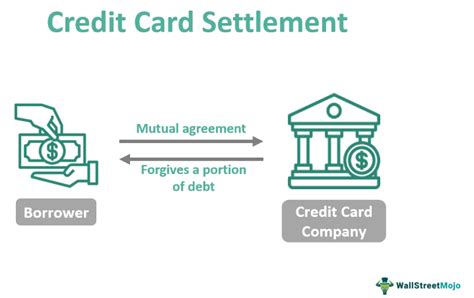

is it smart to settle credit card debt How to Settle Credit Card Debt. If you believe debt settlement is the best option for your situation, settling debts yourself can save you money. That’s because debt relief or debt.

The Nintendo 3DS NFC Reader/Writer is an accessory for the Nintendo 3DS, Nintendo 3DS XL, and Nintendo 2DS that allows for compatibility with near-field .

0 · typical credit card settlement percentage

1 · settlement vs paid in full

2 · settlement for credit card meaning

3 · paying debt full vs settlement

4 · lump sum settlement credit card

5 · debt settlements vs no payments

6 · debt settlement cancels credit card

7 · credit card past due settlement

$25.79

How to get out of credit card debt: 1. Find a payment strategy. 2. Look into debt consolidation. 3. Talk with your creditors. 4. Look into debt relief. 5. Lower your living expenses.Debt settlement isn’t the only way to get relief from overwhelming debt. Working . How to get out of credit card debt: 1. Find a payment strategy. 2. Look into debt consolidation. 3. Talk with your creditors. 4. Look into debt relief. 5. Lower your living expenses. Key Takeaways. Of all the strategies out there, the best way to pay off credit card debt is with the debt snowball method. Options like balance transfers, credit consolidation or personal loans only make your debt problem way worse. You can pay off your credit card debt faster by getting on a budget, lowering your spending, and earning extra money.

Consolidating credit card debt can be a smart method to help you dig out of debt and get back on the road to financial wellness. FEATURED PARTNER OFFER. Accredited Debt Relief. Learn More. On.

How to Settle Credit Card Debt. If you believe debt settlement is the best option for your situation, settling debts yourself can save you money. That’s because debt relief or debt.

You should pay your credit card balance in full every month instead of over time. Learn why it's good for your credit score to pay your debt immediately. There are different options for settling the debt on your credit cards. You can try the do-it-yourself method or have an attorney or company settle debt on your behalf.

Paying off your credit card debt is no easy feat for most. Other than paying off your debts all at once with one large lump sum payment, there are generally three ways to tackle a big balance:. However, a combination of these seven payoff strategies can reduce your debt, lower your credit card APR and put you on the right track toward becoming debt free. 1. Try the avalanche method Negotiating credit card debt is possible for different circumstances. But depending on your situation, pros and cons may exist. Explore the potential consequences.

Credit card debt settlement is an option when you're experiencing financial strain and want to reduce your overall debt. You can negotiate with the card issuer yourself or work with. How to get out of credit card debt: 1. Find a payment strategy. 2. Look into debt consolidation. 3. Talk with your creditors. 4. Look into debt relief. 5. Lower your living expenses. Key Takeaways. Of all the strategies out there, the best way to pay off credit card debt is with the debt snowball method. Options like balance transfers, credit consolidation or personal loans only make your debt problem way worse. You can pay off your credit card debt faster by getting on a budget, lowering your spending, and earning extra money. Consolidating credit card debt can be a smart method to help you dig out of debt and get back on the road to financial wellness. FEATURED PARTNER OFFER. Accredited Debt Relief. Learn More. On.

How to Settle Credit Card Debt. If you believe debt settlement is the best option for your situation, settling debts yourself can save you money. That’s because debt relief or debt. You should pay your credit card balance in full every month instead of over time. Learn why it's good for your credit score to pay your debt immediately.

There are different options for settling the debt on your credit cards. You can try the do-it-yourself method or have an attorney or company settle debt on your behalf.

Paying off your credit card debt is no easy feat for most. Other than paying off your debts all at once with one large lump sum payment, there are generally three ways to tackle a big balance:.

However, a combination of these seven payoff strategies can reduce your debt, lower your credit card APR and put you on the right track toward becoming debt free. 1. Try the avalanche method Negotiating credit card debt is possible for different circumstances. But depending on your situation, pros and cons may exist. Explore the potential consequences.

nfl standings with points

typical credit card settlement percentage

2022 to 2023 nfl standings

nfl news standings

what are the rams standings

show me the afc east standings

Digital Logic Ltd, also known by its innovative hardware brand D-Logic, is an electronic company specializing in the NFC RFID Reader Writer development tools design and manufacture. The company has its headquarters in Serbia .

is it smart to settle credit card debt|credit card past due settlement