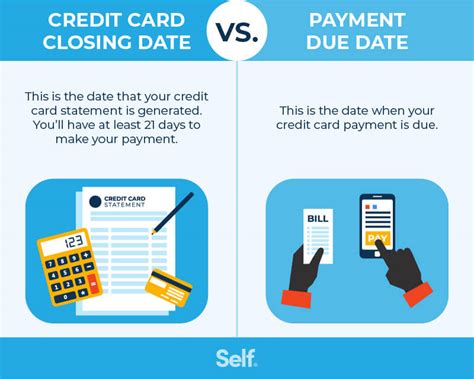

is it smart to pay your credit card bill early Key takeaways. Paying your credit card early means paying your balance before the due date or making an extra payment each month. You may be able to lower your credit utilization ratio by making an extra payment or paying before the statement closing date.

UPDATE : Some users are experiencing problems background tag reading (not using an app) with iOS 15.5. We've started a discussion board at : https://seritag..

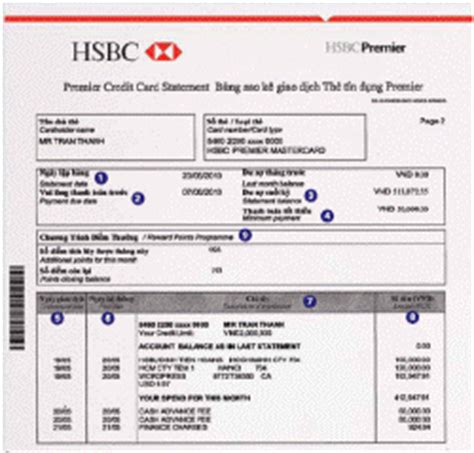

0 · paying credit card in advance

1 · paying credit card before statement

2 · pay before statement closing date

3 · first credit card payment

4 · credit card payment time

5 · capital one statement closing date

6 · capital one quicksilver minimum payment

7 · capital one credit card early payment

I have turned on NFC and Payment in settings, connections, Also turned on .Step 1: Go to Settings on your phone. Step 2: Select Apps and then click on See all apps. Step 3: Next, choose NFC service from the list. Step 4: Click on Storage. Step 5: Now click on the Clear Cache button that appears. .

paying credit card in advance

When you pay your credit card bill before your billing cycleends, the balance amount your card issuer reports to the credit bureaus may be lower than if you paid after your statement closing date. This date is when your card issuer prepares your bill and typically reports your credit card information to the credit . See morePaying your credit card bill in full each month allows you to avoid interest charges altogether, with no remaining balance to carry over into the next month. If that's not an option, it's still . See moreIf your credit card is close to its limit, paying your bill early could free up credit you may need. For example, you may need the extra credit on your card to hold a hotel room . See more Key takeaways. Paying your credit card early means paying your balance before .

Paying your credit card bill early can be a smart strategy, but there are a few things to keep in mind: Could double-pay with autopay: If you have autopay set up, paying your bill too close to the scheduled autopay date could still result in an automatic withdrawal. Key takeaways. Paying your credit card early means paying your balance before the due date or making an extra payment each month. You may be able to lower your credit utilization ratio by making an extra payment or paying before the statement closing date. At the very least, you should pay your credit card bill by its due date every month. If you're like most credit card users, as long as you do that, you're fine. But in some cases, you.

Benefits of Paying Your Bill Early. Reduce Interest Charges. If you pay your card balance in full by the statement due date, you won’t have to pay interest. But if you choose to carry a. Paying your credit card bill early is a simple way to avoid late payment fees. Aside from the fee, missed credit card payments may be reported to the credit bureaus, meaning your credit. Paying your credit card bill early can save you money, boost your credit score and give you flexibility in your budget. So what happens if you pay your credit card bill early? » MORE: When is the. There’s one rule that’s true for all credit card users, no matter the circumstance: Pay your bill on time and in full every month. Contrary to an enduring myth, carrying credit card debt past.

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date.In fact, paying your credit card bill early – or even making more than one payment each billing cycle – can have surprising benefits. Here’s an overview of why you should consider making early credit card payments. You should pay your credit card bill by the due date or else it can affect your credit score. Here's when to pay early and how it can impact your credit score and interest.

Paying your credit card bill early can be a smart strategy, but there are a few things to keep in mind: Could double-pay with autopay: If you have autopay set up, paying your bill too close to the scheduled autopay date could still result in an automatic withdrawal. Key takeaways. Paying your credit card early means paying your balance before the due date or making an extra payment each month. You may be able to lower your credit utilization ratio by making an extra payment or paying before the statement closing date.

At the very least, you should pay your credit card bill by its due date every month. If you're like most credit card users, as long as you do that, you're fine. But in some cases, you.

Benefits of Paying Your Bill Early. Reduce Interest Charges. If you pay your card balance in full by the statement due date, you won’t have to pay interest. But if you choose to carry a.

Paying your credit card bill early is a simple way to avoid late payment fees. Aside from the fee, missed credit card payments may be reported to the credit bureaus, meaning your credit.

Paying your credit card bill early can save you money, boost your credit score and give you flexibility in your budget. So what happens if you pay your credit card bill early? » MORE: When is the. There’s one rule that’s true for all credit card users, no matter the circumstance: Pay your bill on time and in full every month. Contrary to an enduring myth, carrying credit card debt past. Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date.In fact, paying your credit card bill early – or even making more than one payment each billing cycle – can have surprising benefits. Here’s an overview of why you should consider making early credit card payments.

paying credit card before statement

multiband rfid tag design

ACR122U NFC Reader Writer + 5 PCS Ntag213 NFC Tag + Free Software. 4.3 .

is it smart to pay your credit card bill early|credit card payment time