is it smart to close and open credit cards If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage . SBI contactless debit cards can be used to make in-store purchases, online payments, and cash withdrawals in India and around the world. . If the NFC enabled Card is used at an NFC terminal for .Introducing VistaConnect – a free service that adds an online extension to a single business card you keep. Smart scanning technology instantly brings customers to schedules, signup forms and everything else that makes your business go. See our guide. See more

0 · why not to close credit cards

1 · why not close credit cards early

2 · why not close credit cards before 1 year

3 · should i close my credit card early

4 · should i close credit cards before 1 year

5 · should i close credit cards

6 · is it illegal to close credit cards

7 · closing a credit card pros and cons

Get Complete coverage of the 2010 Wild Card games between the Saints and Seahawks on ESPN.com. Introducing the all-new SportsCenter app, a supercharged update to the popular ScoreCenter app packed .

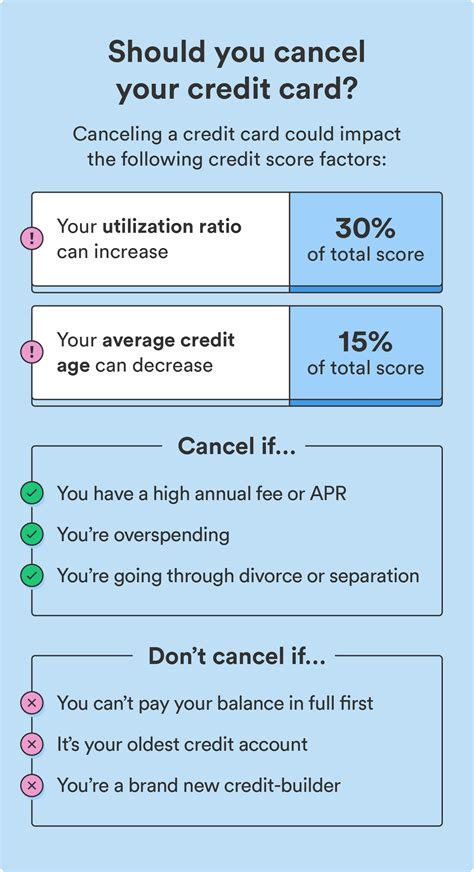

If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage . Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to . If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage .If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. In the long run, maintaining financial health could be much better for your credit score than the benefits of keeping the card account open.

Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to cancel, too. The answer is worth repeating loud and clear: Never, under any circumstances, should you close a credit card less than one year after opening it. While it is possible to do so, there are many reasons why canceling a credit card before the annual fee is due is a bad idea. A crowded wallet and the temptation to spend might have you thinking about canceling unused credit card accounts. In most cases, however, it's best to keep unused credit cards open so you benefit from longer credit history and lower credit utilization (as a result of more available credit). While there are some advantages to closing a credit card you've paid off, it's important to know what closing a credit card won't accomplish. For example, many people think closing a credit card will improve their credit score.

If you plan to cancel a credit card because you no longer want to pay the annual fee, you may be able to keep the account open without the yearly cost. Call your credit card issuer to ask. Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely. Often, there may be smarter ways to achieve your goal of lower costs and less debt. Key Takeaways. People close credit cards for many reasons, including excessive spending, avoiding. But if a credit card has an annual fee, and the value you get from the card doesn't justify continuing to pay it, it can be a smart idea to close it.

why not to close credit cards

If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage .

If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. In the long run, maintaining financial health could be much better for your credit score than the benefits of keeping the card account open. Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to cancel, too.

The answer is worth repeating loud and clear: Never, under any circumstances, should you close a credit card less than one year after opening it. While it is possible to do so, there are many reasons why canceling a credit card before the annual fee is due is a bad idea. A crowded wallet and the temptation to spend might have you thinking about canceling unused credit card accounts. In most cases, however, it's best to keep unused credit cards open so you benefit from longer credit history and lower credit utilization (as a result of more available credit). While there are some advantages to closing a credit card you've paid off, it's important to know what closing a credit card won't accomplish. For example, many people think closing a credit card will improve their credit score. If you plan to cancel a credit card because you no longer want to pay the annual fee, you may be able to keep the account open without the yearly cost. Call your credit card issuer to ask.

why not close credit cards early

Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely.

Often, there may be smarter ways to achieve your goal of lower costs and less debt. Key Takeaways. People close credit cards for many reasons, including excessive spending, avoiding.

simultaneous rfid reader

why not close credit cards before 1 year

should i close my credit card early

should i close credit cards before 1 year

should i close credit cards

RFID 技术应用有哪些呢?. 下面作一个简单的介绍:. 1. 军事物流系统. RFID 技术源于美国,早在二战期间,就用于飞机的敌我识别,在最近几年的局部战争中, RFID 技术已经成功地应用于美军后勤的物流管理,无论是在物资定购中、运输途中、还是在某个仓库存储 .

is it smart to close and open credit cards|why not to close credit cards