is it smart to cancel a credit card It’s common for financial experts to recommend against canceling a credit card. This is because doing so could temporarily hurt your credit score. For one thing, canceling a card could increase. In the NFC programming app, locate the “Write” or “Program” option, typically represented by .https://getconnectedmedia.com - In this video, we're going to show you how to program your own NFC Tags to operate as a digital business card. Conferences an.

0 · what happens to my credit score if i close a card

1 · what happens if you close a credit card

2 · what happens if i cancel a credit card

3 · should you cancel credit cards don't use

4 · is it better to cancel unused credit cards or keep them

5 · how to close a credit card without hurting your

6 · effect of cancelling credit card

7 · deactivate vs cancelling credit card

Visit ESPN for the complete 2024 NFL season standings. Includes league, conference and division standings for regular season and playoffs.

what happens to my credit score if i close a card

gemalto pc express compact smart card reader writer driver

It’s common for financial experts to recommend against canceling a credit card. This is because doing so could temporarily hurt your credit score. For one thing, canceling a card could increase. It’s common for financial experts to recommend against canceling a credit card. This is because doing so could temporarily hurt your credit score. For one thing, canceling a card could increase. So then, is it fine to cancel a credit card before a first account anniversary? And how can opening and closing credit cards for rewards affect your credit? Steps to permanently cancel your credit card. 1. Pay off your remaining credit card balance. 2. Cancel recurring payments. 3. See if you need to redeem your rewards. 4. Call your credit card issuer. 5. Go to your credit card’s website. 6. Follow up .

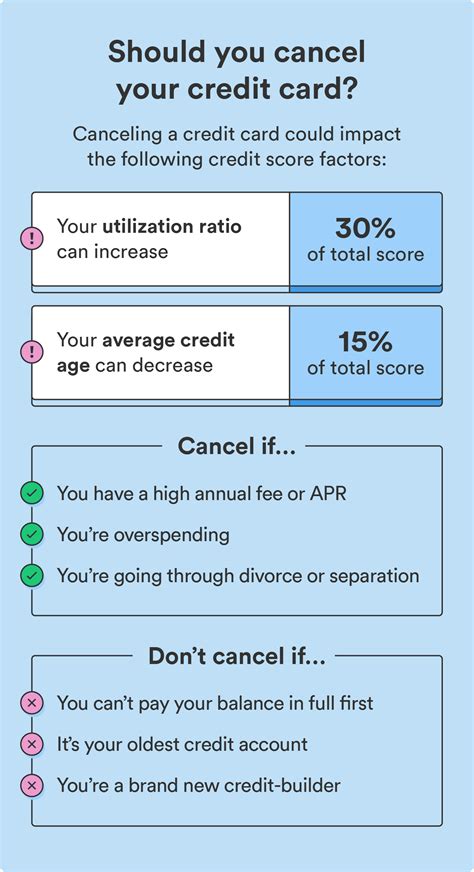

Canceling your credit card can negatively impact your credit score in two main ways: By lowering your credit utilization ratio. One figure that accounts for 30% of your credit score is your.

The pros of closing your credit card account. 1. No more temptation to go into debt: Only you can know: will you be tempted to use that zero balance card again if you don't close the account? If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. To cancel a credit card, you simply need to call the phone number on the back of your card and ask. But before you do that, know that canceling a credit card can affect your credit score , so.Five steps to cancel a credit card. If you decide you are ready to cancel after all, here are the five essential steps you'll want to take. Pay off balance. Pay off your entire balance before you close your credit card to avoid accidentally incurring additional fees. How To Cancel a Credit Card in 6 Steps. Once you decide to cancel a credit card, here’s how you can shut it down: Start by redeeming any unused rewards before canceling.

Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely.

By following these steps, you can cancel your credit card in a way that minimizes negative impacts on your financial health and protects your personal information. It’s common for financial experts to recommend against canceling a credit card. This is because doing so could temporarily hurt your credit score. For one thing, canceling a card could increase. So then, is it fine to cancel a credit card before a first account anniversary? And how can opening and closing credit cards for rewards affect your credit?

what happens if you close a credit card

Steps to permanently cancel your credit card. 1. Pay off your remaining credit card balance. 2. Cancel recurring payments. 3. See if you need to redeem your rewards. 4. Call your credit card issuer. 5. Go to your credit card’s website. 6. Follow up . Canceling your credit card can negatively impact your credit score in two main ways: By lowering your credit utilization ratio. One figure that accounts for 30% of your credit score is your.The pros of closing your credit card account. 1. No more temptation to go into debt: Only you can know: will you be tempted to use that zero balance card again if you don't close the account? If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. To cancel a credit card, you simply need to call the phone number on the back of your card and ask. But before you do that, know that canceling a credit card can affect your credit score , so.

Five steps to cancel a credit card. If you decide you are ready to cancel after all, here are the five essential steps you'll want to take. Pay off balance. Pay off your entire balance before you close your credit card to avoid accidentally incurring additional fees.

How To Cancel a Credit Card in 6 Steps. Once you decide to cancel a credit card, here’s how you can shut it down: Start by redeeming any unused rewards before canceling. Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely.

$8.90

is it smart to cancel a credit card|is it better to cancel unused credit cards or keep them