what is smart card beta Smart beta refers to an enhanced indexing strategy that seeks to exploit certain performance factors in an attempt to outperform a benchmark index. In this sense, smart beta differs . January 4, 2021 • 2:43 pm PST. The 2021 NFL playoffs begin on Jan. 9 and 10 with an expanded wild-card round featuring six total games rather than the usual four. An additional seed in each .

0 · what is smart beta investing

1 · what are smart beta etfs

2 · smart beta vs factor investing

3 · smart beta funds list by performance

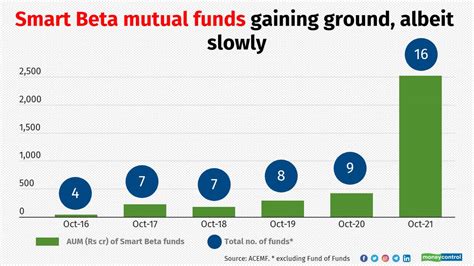

4 · list of smart beta etfs in india

5 · list of smart beta etfs

6 · examples of smart beta etfs

7 · best smart beta etfs

This Animal Crossing: New Horizons guide contains the full Amiibo Card List, specifically series .The Series 5 amiibo cards will release November 5th – the same day as the last major free update for New Horizons and the Happy Home Paradise paid DLC. See more

Smart beta is a strategy that combines elements of passive index investing and actively managed investing. The goal is to outperform indices with lower risk. Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization -based indices. Smart . What is smart beta? Smart beta, also known as strategic beta, is an investment strategy that gets concentrated exposure to investment factors like momentum and quality.

Smart beta refers to an enhanced indexing strategy that seeks to exploit certain performance factors in an attempt to outperform a benchmark index. In this sense, smart beta differs .

1. What are smart beta strategies? Smart beta is a term the industry has broadly used to define non-market-cap-weighted strategies, also sometimes referred to as strategic beta, alternative . Put simply, smart beta is index investing with a twist: Using exchange-traded funds (ETFs), investors try to beat a benchmark index (like the S&P 500) rather than simply match .Smart beta ETFs capture the power of factor investing, fundamentally changing strategies around investment ideas. Learn more about this new way to invest.

Smart beta seeks to capture specific risk premiums or exploit market inefficiencies by deviating from standard market-cap weighting. Smart beta strategies can be rules-based . Summary: Factor-based investing strategies, also known as “smart beta,” track popular stock indices, but offer greater exposure to index constituents with attractive . What Is Smart Beta? Smart Beta refers to investment strategies that aim to capture market returns by selecting securities based on specific factors or characteristics. These strategies differ from traditional market capitalization-weighted indexing or active management. Smart beta is a strategy that combines elements of passive index investing and actively managed investing. The goal is to outperform indices with lower risk.

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization -based indices. Smart beta emphasizes.

what is smart beta investing

What is smart beta? Smart beta, also known as strategic beta, is an investment strategy that gets concentrated exposure to investment factors like momentum and quality.Smart beta refers to an enhanced indexing strategy that seeks to exploit certain performance factors in an attempt to outperform a benchmark index. In this sense, smart beta differs fundamentally from a traditional passive indexing strategy.

gemalto smart card reader driver windows 10 64-bit

1. What are smart beta strategies? Smart beta is a term the industry has broadly used to define non-market-cap-weighted strategies, also sometimes referred to as strategic beta, alternative beta, or advanced beta. Morningstar now estimates that there is more than 0 billion in strategic beta assets under management Put simply, smart beta is index investing with a twist: Using exchange-traded funds (ETFs), investors try to beat a benchmark index (like the S&P 500) rather than simply match the benchmark’s performance as with traditional index investing. .Smart beta ETFs capture the power of factor investing, fundamentally changing strategies around investment ideas. Learn more about this new way to invest.

Smart beta seeks to capture specific risk premiums or exploit market inefficiencies by deviating from standard market-cap weighting. Smart beta strategies can be rules-based and transparent, offering investors a clear understanding of . Summary: Factor-based investing strategies, also known as “smart beta,” track popular stock indices, but offer greater exposure to index constituents with attractive characteristics, or “factors.” Here’s what investors should know. Investors who passively tracked benchmark stock and bond indices in 2022 likely felt the pain of steep losses. What Is Smart Beta? Smart Beta refers to investment strategies that aim to capture market returns by selecting securities based on specific factors or characteristics. These strategies differ from traditional market capitalization-weighted indexing or active management.

what are smart beta etfs

Smart beta is a strategy that combines elements of passive index investing and actively managed investing. The goal is to outperform indices with lower risk. Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization -based indices. Smart beta emphasizes.

What is smart beta? Smart beta, also known as strategic beta, is an investment strategy that gets concentrated exposure to investment factors like momentum and quality.Smart beta refers to an enhanced indexing strategy that seeks to exploit certain performance factors in an attempt to outperform a benchmark index. In this sense, smart beta differs fundamentally from a traditional passive indexing strategy.

1. What are smart beta strategies? Smart beta is a term the industry has broadly used to define non-market-cap-weighted strategies, also sometimes referred to as strategic beta, alternative beta, or advanced beta. Morningstar now estimates that there is more than 0 billion in strategic beta assets under management

Put simply, smart beta is index investing with a twist: Using exchange-traded funds (ETFs), investors try to beat a benchmark index (like the S&P 500) rather than simply match the benchmark’s performance as with traditional index investing. .Smart beta ETFs capture the power of factor investing, fundamentally changing strategies around investment ideas. Learn more about this new way to invest.

Smart beta seeks to capture specific risk premiums or exploit market inefficiencies by deviating from standard market-cap weighting. Smart beta strategies can be rules-based and transparent, offering investors a clear understanding of .

smart beta vs factor investing

higher one smart card

emv smart credit card

Cool Rolex of the Day #2362: 116518 Daytona with blue racing dial, 18k yellow gold on leather strap, 40mm. Circa 2007

what is smart card beta|best smart beta etfs