cryptocurrency contactless card luxembourg Nowadays, cryptocurrency is used by an increasing number of people from all over the world. As seen in the figure below, crypto adoption is increasing at a similar rate as the internet. Since digital assets are part of our daily lives, more people are becoming interested . See more Smart IC Card Reader, USB NFC Contactless Smart Reader 13.56MHz .

0 · Top 8 Crypto Debit Cards in Europe

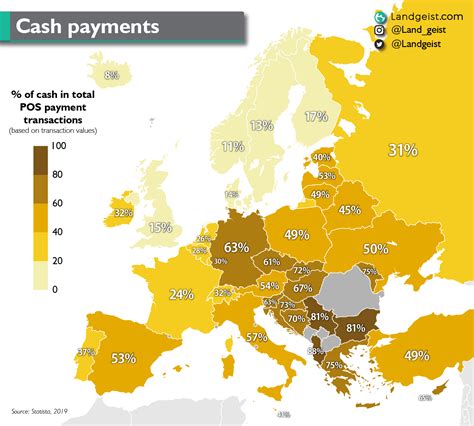

1 · Money Maps: Unpacking payments in Europe

2 · KuCoin Launches Visa

3 · Five key facts about crypto

Sunday, Jan. 14. 8 p.m. ET. NBC. Puka Nacua Over 75.5 Receiving Yards (-115) By Cody Goggin. Puka Nacua has had statistically the best season of any rookie receiver in NFL history. Coming out of seemingly nowhere, the fifth-round pick .

Crypto debit cards allow individuals to use their crypto assets to purchase online and in-person products and services. Crypto cardholders can use this physical card for transactions . See moreAs a cryptocurrency investor and holder, you want to use and access your digital assets as easily as possible. Luckily, as a European resident, you have plenty of crypto debit card . See moreNowadays, cryptocurrency is used by an increasing number of people from all over the world. As seen in the figure below, crypto adoption is increasing at a similar rate as the internet. Since digital assets are part of our daily lives, more people are becoming interested . See moreYou can use a cryptocurrency debit card to make purchases just like a traditional debit card. A crypto debit card acts like a prepaid card and can be loaded with crypto to make in . See more

European debit cards incorporate several advanced security features to ensure the safety of transactions and protect users against fraud, . See more In addition, the card integrates with Apple Pay and Google Pay for contactless smartphone payments for added convenience and security.

This blog article looks into the crypto-assets regulatory framework at global, European and local levels, and examines Luxembourg’s crypto-assets industry, highlighting . 6. UK. Outside of the EU, UK consumers are embracing new payments technology with in-store payment transactions by mobile wallets forecast to double to 29% in 2027 from .

A crypto debit card acts like a prepaid card and can be loaded with crypto to make in-store or online purchases from merchants who don’t otherwise accept cryptocurrency. Many crypto debit cards are supported by traditional credit card companies. In addition, the card integrates with Apple Pay and Google Pay for contactless smartphone payments for added convenience and security. This blog article looks into the crypto-assets regulatory framework at global, European and local levels, and examines Luxembourg’s crypto-assets industry, highlighting five key facts drawn from a recent market study.

6. UK. Outside of the EU, UK consumers are embracing new payments technology with in-store payment transactions by mobile wallets forecast to double to 29% in 2027 from 14% in 2023. The country also has the highest usage of contactless payments in Europe, while just 15% of in-store transactions by value are made in cash. Here’s a look at some of the key emerging technologies in credit card processing and how they’re transforming the way we pay. 1. Contactless and Tap-to-Pay Technology. Contactless payments, often referred to as “tap-to-pay,” have become mainstream, especially following the COVID-19 pandemic. There are two types of contactless payment solutions: contactless cards and mobile device payments (smartphones or connected watches). In Luxembourg, all the major banks offer NFC-enabled cards (credit cards and V PAY debit cards).

It’s so convenient! No more coins dropping out of your purse and getting lost! Use your contactless credit card to pay for your day-to-day purchases. It is just as secure — but much more practical! And it’s fast. It only takes a second or two to pay.The Mastercard New Payments Index, conducted across 18 markets around the world, shows 93% of people will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR code, in the next year.

Contactless connections. Inspiration. Contactless, crypto-currencies, the digital euro. From cash to digital, the exchange code to computer code, money is becoming increasingly disembodied, with 90% of the world's money now in virtual form.

Customers will be able to purchase cryptocurrency using their PayPal balance, linked bank accounts or EU-issued debit cards. If customers choose to sell cryptocurrency with this new service, funds will be available quickly in their PayPal accounts. PayPal is registered in Luxembourg as a Virtual Asset Service Provider (VASP). A crypto debit card acts like a prepaid card and can be loaded with crypto to make in-store or online purchases from merchants who don’t otherwise accept cryptocurrency. Many crypto debit cards are supported by traditional credit card companies. In addition, the card integrates with Apple Pay and Google Pay for contactless smartphone payments for added convenience and security.

Top 8 Crypto Debit Cards in Europe

This blog article looks into the crypto-assets regulatory framework at global, European and local levels, and examines Luxembourg’s crypto-assets industry, highlighting five key facts drawn from a recent market study.

6. UK. Outside of the EU, UK consumers are embracing new payments technology with in-store payment transactions by mobile wallets forecast to double to 29% in 2027 from 14% in 2023. The country also has the highest usage of contactless payments in Europe, while just 15% of in-store transactions by value are made in cash. Here’s a look at some of the key emerging technologies in credit card processing and how they’re transforming the way we pay. 1. Contactless and Tap-to-Pay Technology. Contactless payments, often referred to as “tap-to-pay,” have become mainstream, especially following the COVID-19 pandemic. There are two types of contactless payment solutions: contactless cards and mobile device payments (smartphones or connected watches). In Luxembourg, all the major banks offer NFC-enabled cards (credit cards and V PAY debit cards).

It’s so convenient! No more coins dropping out of your purse and getting lost! Use your contactless credit card to pay for your day-to-day purchases. It is just as secure — but much more practical! And it’s fast. It only takes a second or two to pay.

The Mastercard New Payments Index, conducted across 18 markets around the world, shows 93% of people will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR code, in the next year.Contactless connections. Inspiration. Contactless, crypto-currencies, the digital euro. From cash to digital, the exchange code to computer code, money is becoming increasingly disembodied, with 90% of the world's money now in virtual form.

Money Maps: Unpacking payments in Europe

Virtual Smart Card Architecture is an umbrella project for various projects concerned with the emulation of different types of smart card readers or smart cards themselves. Currently the following projects are part of Virtual .

cryptocurrency contactless card luxembourg|Five key facts about crypto